Most people assume pharmacies make the most money from expensive brand-name drugs. But that’s not how it works. In reality, generic drugs are the real profit engine for pharmacies - even though they cost a fraction of the price. A $5 generic antibiotic might seem like a bargain, but it’s the reason many pharmacies stay open at all. Meanwhile, a $1,200 brand-name pill might bring in less than $5 in actual profit after all the costs are paid. This is the strange, hidden math behind every prescription you fill.

Why Generics Are the Hidden Profit Machine

Generics make up about 90% of all prescriptions filled in the U.S. But they only account for about 25% of total drug spending. That’s because brand-name drugs are priced sky-high - sometimes hundreds or even thousands of dollars per pill - while generics cost pennies. So how do pharmacies make money off something so cheap? It’s all about markup percentage.

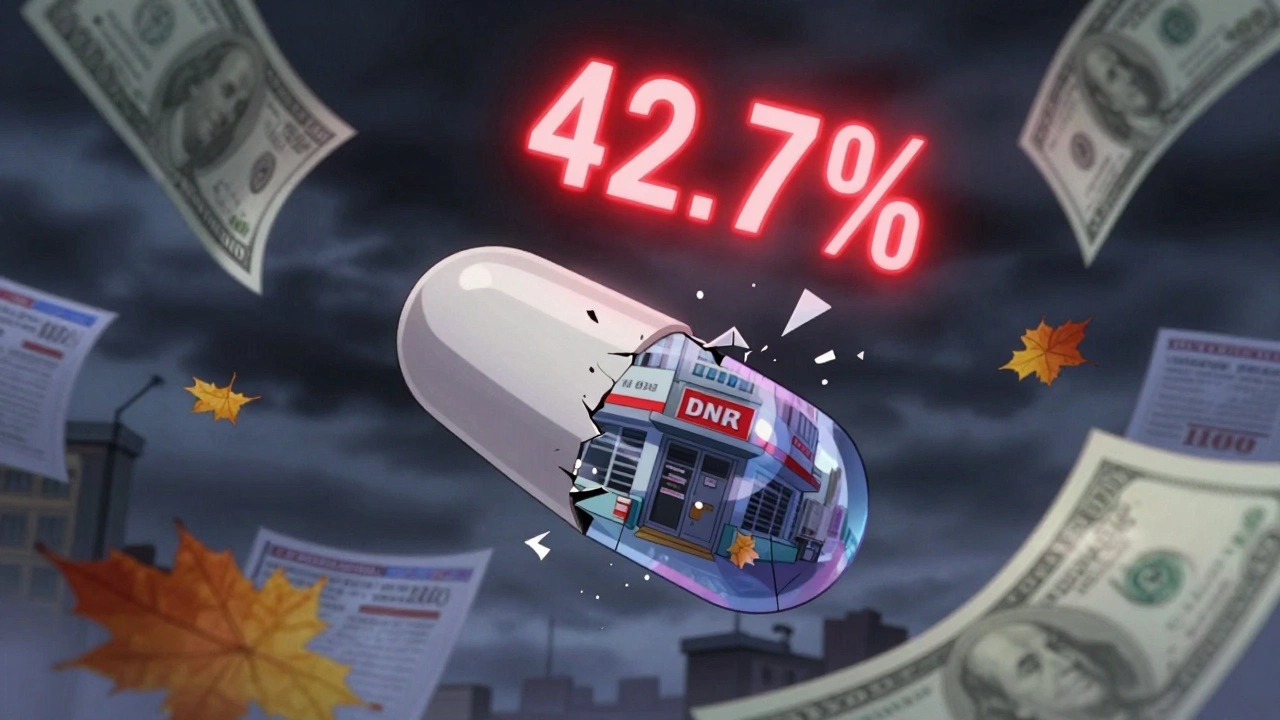

Here’s the key number: pharmacies make an average gross margin of 42.7% on generic drugs. That means for every $100 a patient pays for a generic, the pharmacy keeps about $43 before paying rent, staff, utilities, or insurance processing fees. Compare that to brand-name drugs, where the gross margin is just 3.5%. Even if a brand drug sells for $1,000, the pharmacy might only pocket $35. And that’s before the pharmacy benefit managers (PBMs) take their cut.

This isn’t a glitch. It’s by design. The system was built this way because generics are low-risk, high-volume products. Pharmacies can buy a bottle of 100 generic pills for $5 and sell them for $15 - a 200% markup. With brand drugs, the manufacturer sets the price, and pharmacies have little control. The higher the list price, the more the PBM negotiates down - and the less the pharmacy gets.

Who Really Gets the Money?

It’s easy to blame pharmacies for high drug prices. But the real money flows through a tangled web of middlemen. Take a $100 generic prescription. Here’s where the money goes:

- Manufacturer: gets about $18 for producing the drug

- Wholesaler: takes about $5

- PBM: pockets $32 through spread pricing

- Pharmacy: keeps $32 as gross margin

- Insurance plan: pays $100

That’s right - the pharmacy and the PBM each make roughly the same amount on a generic, even though the PBM doesn’t touch the pill. PBMs charge insurers more than they pay pharmacies, and keep the difference. That’s called “spread pricing.” And it’s one of the biggest reasons independent pharmacies are struggling.

For brand-name drugs, the manufacturer keeps the lion’s share - about $58 out of every $100 spent. Pharmacies barely get $3. That’s why pharmacies rely on volume. They need to fill hundreds of generics just to make up for the low profit on a few expensive brands.

The Crunch on Independent Pharmacies

If you’ve walked into a small-town pharmacy lately, you might have noticed it’s closing. Between 2018 and 2023, about 3,000 independent pharmacies shut down in the U.S. Why? Because their net profit - after rent, payroll, insurance claims, and PBM clawbacks - is often just 2% of the prescription price.

Five years ago, many independent pharmacies made 8-10% net profit on generics. Now, it’s down to 2%. Meanwhile, overhead has gone up 35%. Rent, staff wages, compliance costs, and electronic health record systems don’t get cheaper. But reimbursement from PBMs? It keeps dropping.

One Ohio pharmacy owner told Pharmacy Times: “I’m filling more prescriptions than ever, but I’m working 70-hour weeks just to break even.” That’s not unusual. PBMs use opaque formulas to set reimbursement rates. Sometimes, they pay pharmacies less than what they paid for the drug - then demand the difference back. That’s called a “clawback.”

And it’s getting worse. When only one company makes a generic drug - called a “single-source generic” - there’s no competition. Prices spike. In some cases, the single-source generic now costs more than the original brand-name drug. That’s not a mistake. It’s a market failure.

How Mail-Order Pharmacies Win Big

While your local pharmacy struggles, mail-order pharmacies are thriving. Why? They buy in massive volumes and negotiate directly with PBMs. They also don’t have the same overhead - no walk-in customers, no in-store staff, no pharmacy counters.

For generic drugs, mail-order pharmacies make more than four times the margin of a small grocery store pharmacy. For brand drugs, they make over 35 times more. In some cases, they’re making 1,000 times the margin on a generic compared to a small pharmacy. That’s not because they’re better at running a business. It’s because they’re part of a vertical system - often owned by the same company that runs the PBM and the insurance plan.

CVS, OptumRx, and Express Scripts control about 80% of all prescription transactions in the U.S. They’re not just middlemen - they’re vertically integrated giants. They own pharmacies, PBMs, insurance plans, and even drug manufacturers. That gives them total control over pricing, reimbursement, and profits.

What Pharmacies Are Doing to Survive

Independent pharmacies aren’t just waiting to die. Many are fighting back.

- Some are switching to direct pay models - letting patients pay cash for generics at a transparent price, bypassing PBMs entirely.

- Others are offering medication therapy management (MTM) services - checking in with patients on their drug regimens, helping them avoid side effects, and coordinating with doctors. These services are reimbursed separately and can add $10-$20 per visit.

- A few are partnering with local employers to offer direct contracts, cutting out the PBM altogether.

- Some are opening specialty pharmacy divisions to handle complex, high-cost drugs for conditions like cancer or rheumatoid arthritis. These drugs come with higher margins and fewer price controls.

Mark Cuban’s Cost Plus Drug Company is another example. They sell 100 generic pills for $20 plus a $3 dispensing fee. No spreads. No clawbacks. Just cost plus a flat fee. They’ve filled over a million prescriptions since 2023. And they’re proving that transparency works.

Amazon Pharmacy has followed suit, offering many generics for $5 with clear pricing. These new players are forcing the old system to change - slowly.

The Future: More Consolidation or Real Reform?

The trend isn’t promising. The top five generic manufacturers now control 45% of the market, up from 32% in 2015. Fewer competitors mean less price pressure. The Federal Trade Commission has filed lawsuits against generic makers for price-fixing. But enforcement is slow.

Meanwhile, state laws in California, Texas, and Illinois now require PBMs to disclose their reimbursement formulas. The Inflation Reduction Act will let Medicare negotiate drug prices starting in 2026 - but that mostly affects brand-name drugs. Generics are mostly untouched.

Goldman Sachs predicts 20-25% more independent pharmacies will close by 2027 unless reimbursement rules change. But there’s hope. Pharmacies that diversify - adding MTM, specialty services, or direct pay models - are seeing net margins climb to 4-6%. That’s not enough to get rich, but it’s enough to survive.

The truth is, pharmacies don’t make money because they’re greedy. They make money because the system forces them to. Generics are the only thing keeping them afloat. And if that system breaks - if generic prices collapse further or competition vanishes - then the whole structure could come undone.

What This Means for You

If you’re paying cash for a generic, you’re getting the best deal. Ask your pharmacist: “What’s your cash price?” Often, it’s cheaper than your insurance copay - even if you have coverage.

If you’re on a long-term medication, consider switching to a direct-pay model. Companies like Cost Plus Drug Company or Amazon Pharmacy offer transparent pricing. You’ll know exactly what you’re paying for - and who’s making the profit.

And if you’re worried about your local pharmacy closing - support it. Buy your refills there. Ask your state representative about PBM transparency laws. The pharmacy down the street isn’t just a business. It’s a community lifeline.

Why do pharmacies make more profit on cheap generics than expensive brand-name drugs?

It’s about markup percentage, not total price. A $5 generic might cost a pharmacy $2 to buy and sell for $5 - that’s a 150% markup. A $1,000 brand-name drug might cost $900 and sell for $950 - only a 5.5% markup. Pharmacies make more per pill on generics because they’re cheaper to buy and easier to sell in bulk. Even with lower gross profits per dollar spent, the volume and margin combine to make generics the main profit driver.

What is spread pricing, and how does it hurt pharmacies?

Spread pricing is when a pharmacy benefit manager (PBM) charges an insurance plan more than what they reimburse the pharmacy. The difference - the “spread” - goes to the PBM as profit. For example, the PBM might charge the insurer $100 for a generic, but only pay the pharmacy $70. The pharmacy loses $30. This practice hides the real cost of drugs and squeezes pharmacy margins, especially for independents who can’t negotiate better rates.

Why are some generic drugs more expensive than brand-name drugs?

It happens when only one company makes the generic - called a single-source generic. Without competition, that manufacturer can raise prices. In some cases, the single-source generic ends up costing more than the original brand. This is especially common with older drugs that have low profit margins and few manufacturers willing to produce them. Supply chain issues and consolidation in the generic industry make this problem worse.

Can I save money by paying cash instead of using insurance for generics?

Yes, often. Insurance copays are based on negotiated PBM rates, which can be inflated. Many pharmacies offer cash prices that are lower than your insurance copay - especially for common generics like metformin, lisinopril, or atorvastatin. Always ask your pharmacist: “What’s your cash price?” You might save 50% or more.

What’s the difference between gross margin and net profit for pharmacies?

Gross margin is what the pharmacy earns before paying rent, staff, utilities, or insurance fees. For generics, it’s about 42.7%. But after all expenses, the net profit is often just 2%. That’s why a pharmacy might seem profitable on paper but still struggle to pay bills. Net profit is what’s left after everything else is paid - and that’s what keeps the doors open.

Pharmacies are caught in a system designed to favor big players. Generics keep them alive - but barely. The future depends on whether transparency, competition, and reform can catch up to the profit machine that’s been running for decades.

Declan Flynn Fitness

December 2, 2025 AT 08:31Louise Girvan

December 2, 2025 AT 15:57Tommy Walton

December 3, 2025 AT 08:45Grant Hurley

December 4, 2025 AT 03:57Michelle Smyth

December 5, 2025 AT 16:58Adrian Barnes

December 6, 2025 AT 15:59patrick sui

December 8, 2025 AT 12:50Dennis Jesuyon Balogun

December 9, 2025 AT 15:51James Steele

December 11, 2025 AT 15:11soorya Raju

December 13, 2025 AT 14:49Linda Migdal

December 14, 2025 AT 20:44Lucinda Bresnehan

December 16, 2025 AT 10:19Patrick Smyth

December 17, 2025 AT 06:36